Check my Refund Status

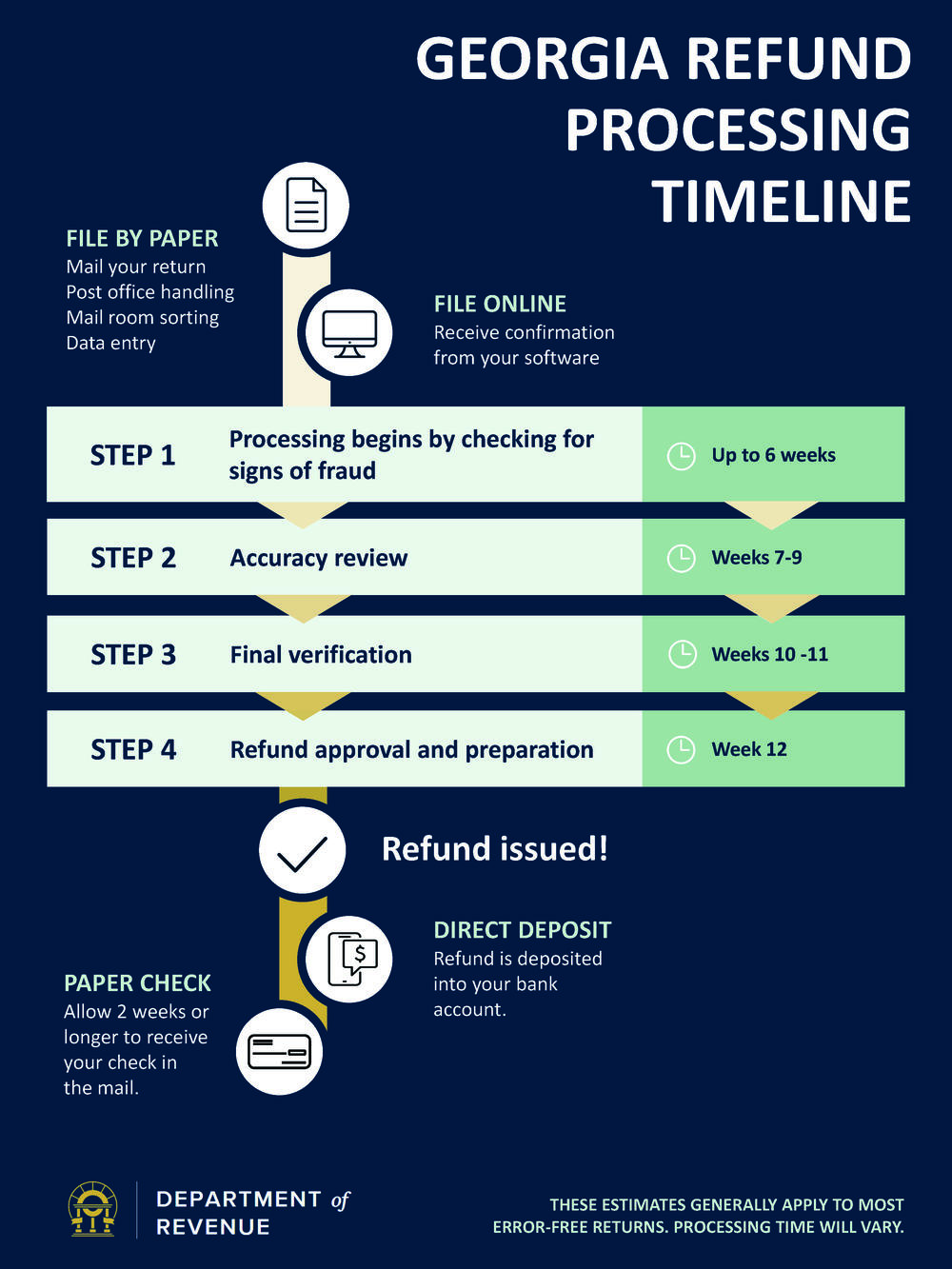

After submitting your return, please allow at least 2-3 weeks of processing time before checking your refund status.

Looking for information on the Surplus Tax Refund?

What you'll need

- Social security number of taxpayer

- Expected amount of the refund

Ways to check your status

- Check your refund online (does not require a login)

- Sign up for Georgia Tax Center (GTC) account. GTC provides online access and can send notifications such as when a refund has been issued

- Use the automated telephone service at 877-423-6711

When should I call?

Only if your refund status in our Check my Refund Status application:

- Hasn’t changed in more than 6 weeks

- Tells you to contact the Department

Our phone lines are typically busy this time of year. Our call center representatives have the same information as our Check my Refund Status application.

You may also need

Note: Some tax returns may take longer to process due to errors or incomplete information