Transportation Funding Act of 2015 (HB 170)

Summary

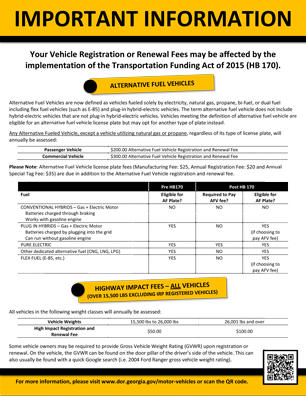

Under House Bill 170, alternative fuel vehicles are now defined as vehicles fueled solely by electricity, natural gas, propane, bi-fuel, or dual fuel including flex fuel vehicles (such as E-85) and plug-in hybrid-electric vehicles. The term alternative fuel vehicle does not include hybrid-electric vehicles that are not plug-in hybrid-electric vehicles. Vehicles meeting the definition of alternative fuel vehicle are eligible for an alternative fuel vehicle license plate but may opt for another type of plate instead.

House Bill 170 created new annual alternative fuel vehicle fees. The fees apply to all vehicles that operate solely on electricity regardless of whether the owner uses an alternative fuel vehicle license plate. The fees apply to plug-in hybrid-electric or flex fuel vehicles (such as E-85) only if those vehicles have elected an alternative fuel vehicle license plate. The fees do not apply to alternative fuel vehicles which operate primarily on compressed natural gas, liquefied natural gas, or liquefied petroleum gas but such vehicles are still eligible for the alternative fuel vehicle license plate. The fees do not apply to hybrid-electric vehicles that are not plug-in hybrid-electric vehicles and such vehicles do not qualify for the alternative fuel vehicle license plate. For non-commercial alternative fuel vehicles, the annual fee is $200.00. For commercial alternative fuel vehicles, the annual fee is $300.00. These fees are in addition to all other existing license plate fees and any taxes.

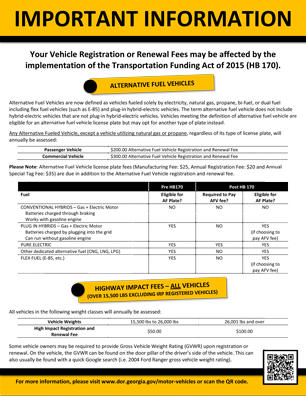

House Bill 170 created new annual highway user impact fees for all motor vehicles which are 15,500 lbs. and greater. For vehicles weighing 15,500 lbs. to 26,000 lbs. the annual highway user impact fee is $50.00. For vehicles weighing 26,001 lbs. and greater the annual highway user impact fee is $100.00.

House Bill 170 eliminated the zero emission and low emission income tax credit available to purchasers and lessees of new motor vehicles. The income tax credit may only be claimed by persons who purchase or lease a qualifying vehicle before July 1, 2015.

Frequently Asked Questions

Alternative Fuel Vehicle License Plates

Annual Alternative Fuel Vehicle Fees

Heavy Vehicle Highway User Impact Fee

Alternative Fuel Vehicle License Plate Eligibility

|

Pre HB 170 |

Post HB 170 |

||

|---|---|---|---|

|

Fuel |

Eligible for AF Plate? |

Required to Pay AFV Fee? |

Eligible for AF Plate? |

|

Conventional Hybrids - Gas + Electric Motor Batteries charged through braking Works with gasoline engine |

No |

No |

No |

|

Plug-in Hybrids - Gas + Electric Motor Batteries charged by plugging into the grid Can run without gasoline engine |

Yes |

No |

Yes (if choosing to pay AFV Fee) |

|

Pure Electric |

Yes |

Yes |

Yes |

|

Other dedicated alternative fuel (CNG, LNG, LPG) |

Yes |

No |

Yes |

|

Flex Fuel (E-85, etc.) |

Yes |

No |

Yes (if choosing to pay AFV Fee) |

|

Note: AFV Fee is $200 for non-commercial vehicles and $300 for commercial vehicles. |

|||